Sustainable Finance

Marketplace

Marketplace to connect climate-positive projects with green lenders

Zero Circle's sustainable loan marketplace is an innovative, AI-driven platform that pre-qualifies and connects businesses with a variety of green loans tailored to their specific sustainability goals. These goals range from energy-efficient upgrades to significant investments in clean technology. By facilitating these connections, the platform allows lenders to expand and diversify their portfolios by partnering with responsible businesses committed to promoting positive environmental change. The marketplace will help reduce the inherent risks associated with traditional lending practices but also enhances lenders' reputations as leaders in sustainability within the financial industry.

Climate projects

Accelerate your climate and energy initiative with streamlined underwriting and reduced capital costs.

Green lenders

Green lending products

C-PACE

Back renewable energy, sustainable farms & green tech with tailored financing solutions like green bonds & sustainability loans.

Government Grants Assistance

Secure government funding and grants to accelerate sustainability efforts and drive positive change.

Sustainable Equipment Financing

Make your operations more sustainable by financing eco-friendly equipment.

Sustainable Supply Chain

Help your supply chain go green with eco-friendly funding and Zero Circle’s guidance.

Fund Your BioChar Project

Access financing to develop and expand biochar projects, contributing to soil health and carbon sequestration.

Fund Your Real Estate Project

Get the funds to build green real estate projects prioritizing energy efficiency and sustainable building practices.

Green lending products

C-PACE

Provides 100% long-term financing for energy efficiency, renewable energy, and resiliency upgrades in commercial properties, repaid through property tax assessments

Greenhouse Gas Reduction Fund

SBA 504 Green Loan

Offers up to $5.5 million in SBA financing per project for energy-efficient improvements, with no limit on the number of loans for qualifying businesses

Power Purchase Agreement (PPA)

A long-term contract between energy buyers and sellers for renewable energy, providing fixed pricing and enabling project financing

Climate Project Financing

Includes grants, concessional loans, and equity investments from various sources to fund climate mitigation and adaptation projects

Equipment Financing

Specialized loans or leases for purchasing green construction equipment and other sustainable technologies

Sustainability-Linked Loans

Loans with interest rates tied to the borrower's achievement of predetermined sustainability performance targets

Green Bonds

Fixed-income financial instruments used to fund projects with positive environmental benefits, following Green Bond Principles

Supply Chain Finance (SCF)

Optimize cash flow by extending payment terms while providing suppliers early payment at discounted rates, leveraging the buyer's stronger credit rating to create a win-win financial ecosystem.

A streamlined customer journey.

Access a curated selection of financial products such as

- Sustainability-Linked Loans with flexible terms tied to environmental KPIs

- GGRF and CPACE for specific decarbonization projects (e.g., solar adoption, infrastructure optimization)

Streamlined Documentation Automation: Effortlessly generate lender-ready Impact Performance Scorecards that integrate financial metrics, sustainability KPIs, and carbon footprints, ensuring compliance with lender-specific green criteria and minimizing the need for revisions.

Unified Communication Platform: Enhance collaboration between lenders and borrowers with a centralized hub for term sheet reviews, clarifications, and real-time progress updates, complemented by automated compliance alerts and document requests.

Enhanced Transparency and Accountability: Empower lenders to monitor project milestones and sustainability metrics, such as emissions tracking via the Carbon Circle API, for greater oversight and support throughout the project lifecycle.

After funding, our tools simplify sustainability reporting and keep you on track with key metrics:

- Carbon Emission Reduction Monitoring: Utilize the Carbon Circle API for comprehensive Scope 3 reporting.

- ROI Analysis: Assess financial return on investment in alignment with your initial Impact Performance Memo.

- Compliance and Reporting: Receive alerts for green finance standards and automate report generation for stakeholders.

We offer continuous support to ensure measurable outcomes and maintain eligibility for future funding rounds.

We start by creating an Impact Performance Memo (IPM) detailing your organization's Project Details Company Profile, Sustainability Impacts, and Financial Performance to show lenders how your project meets their impact goals and lending requirements.

We leverage AI technology and our extensive network of financial institutions to assess your project type—whether it's renewable energy, waste-to-energy, or energy efficiency—as well as its geographical location, projected financials, and scale. This enables us to connect you with the best financing options available.

Leverage Zero Circle’s AI-powered platform to automate sustainability evaluations and financial health assessments, ensuring your project meets lender criteria.

Access a curated selection of financial products such as

- Sustainability-Linked Loans with flexible terms tied to environmental KPIs

- GGRF and CPACE for specific decarbonization projects (e.g., solar adoption, infrastructure optimization)

Zero Circle’s platform streamlines application processes by pre-filling documentation and integrating directly with partner lenders’ systems

Streamlined Documentation Automation: Effortlessly generate lender-ready Impact Performance Scorecards that integrate financial metrics, sustainability KPIs, and carbon footprints, ensuring compliance with lender-specific green criteria and minimizing the need for revisions.

Unified Communication Platform: Enhance collaboration between lenders and borrowers with a centralized hub for term sheet reviews, clarifications, and real-time progress updates, complemented by automated compliance alerts and document requests.

Enhanced Transparency and Accountability: Empower lenders to monitor project milestones and sustainability metrics, such as emissions tracking via the Carbon Circle API, for greater oversight and support throughout the project lifecycle.

Post-funding, our tools automate sustainability reporting and monitor key metrics.

After funding, our tools simplify sustainability reporting and keep you on track with key metrics:

- Carbon Emission Reduction Monitoring: Utilize the Carbon Circle API for comprehensive Scope 3 reporting.

- ROI Analysis: Assess financial return on investment in alignment with your initial Impact Performance Memo.

- Compliance and Reporting: Receive alerts for green finance standards and automate report generation for stakeholders.

We offer continuous support to ensure measurable outcomes and maintain eligibility for future funding rounds.

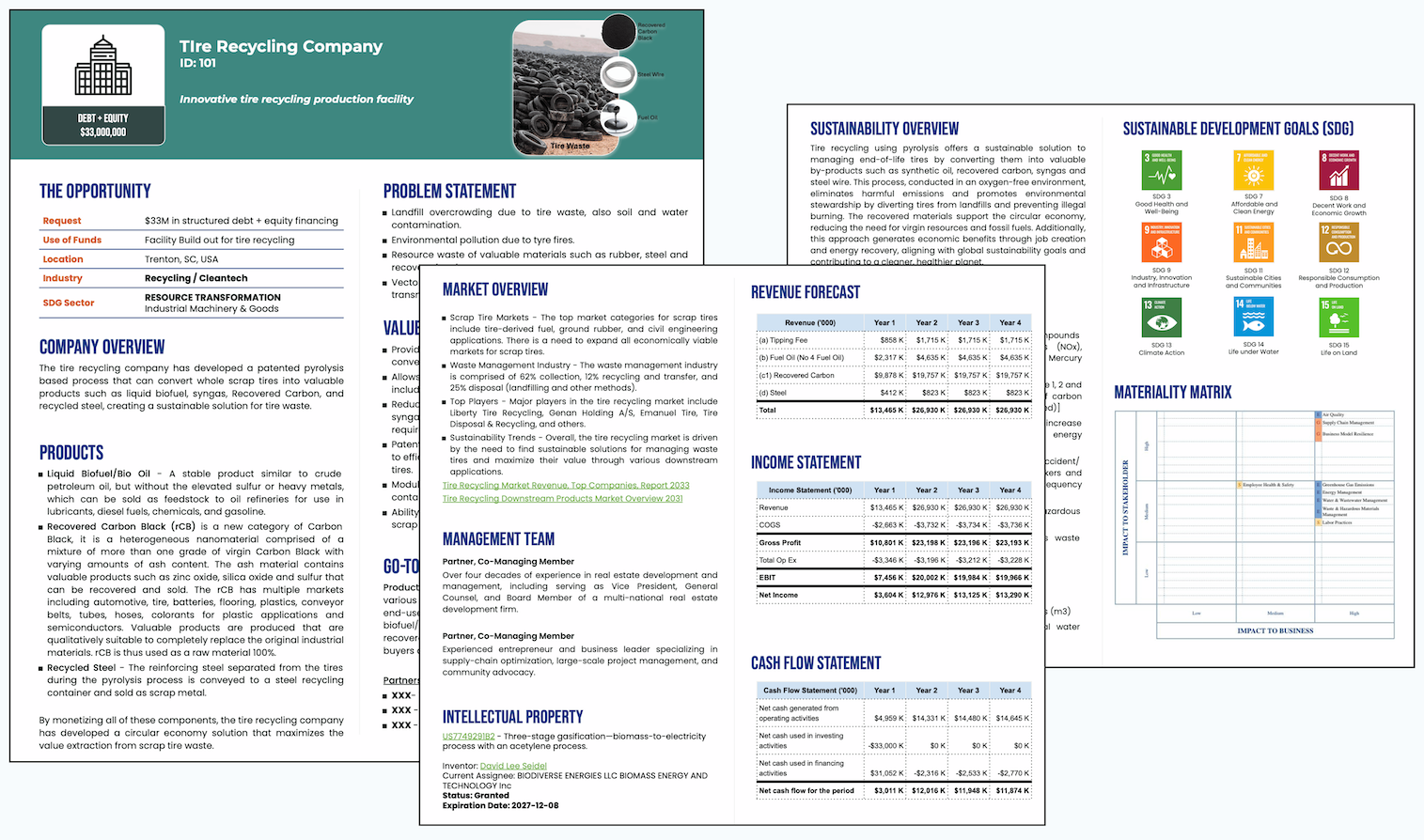

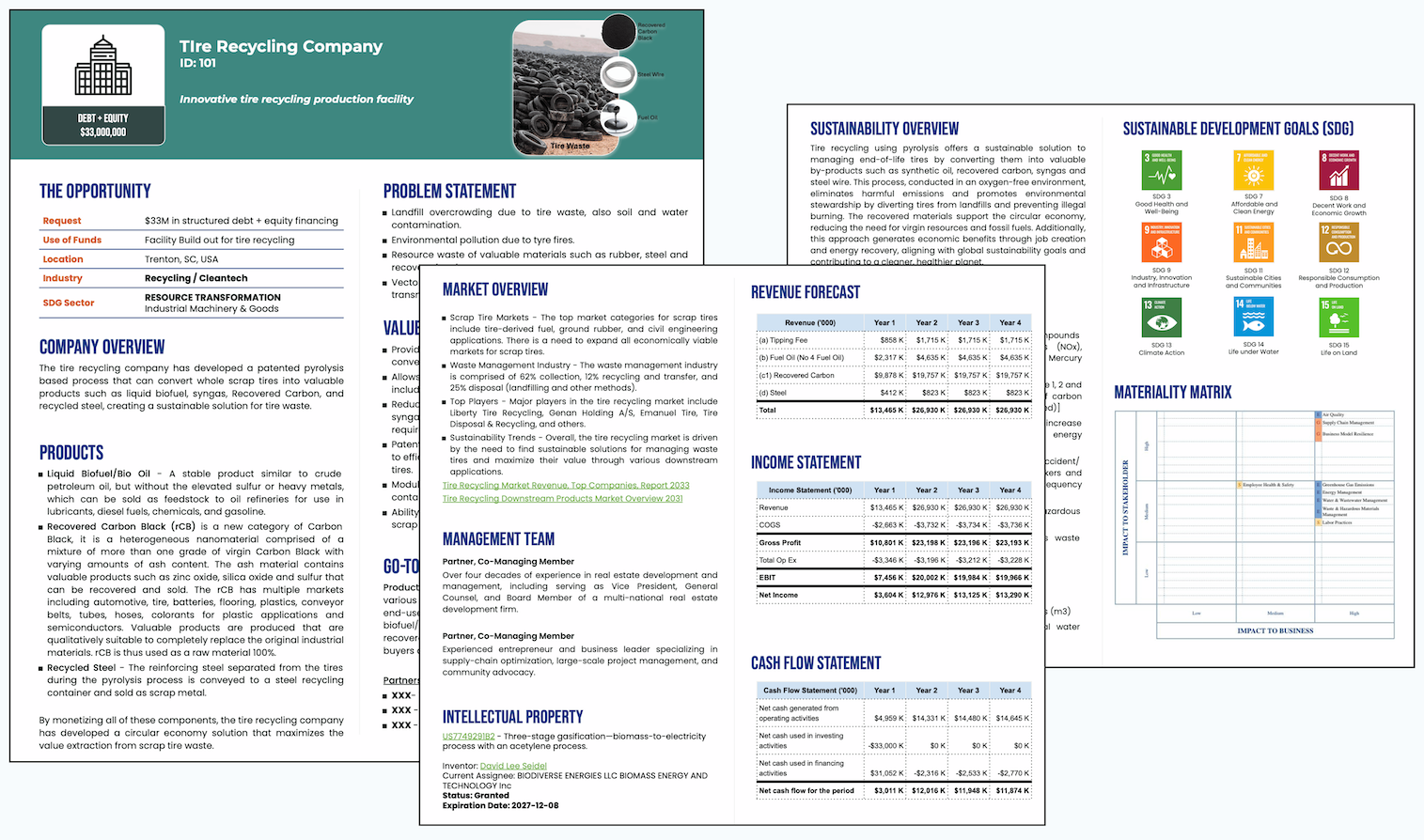

How does Sustainable Finance Marketplace work?

Step 1

Impact Performance Memo(IPM) Creation

We start by creating a comprehensive Impact Performance Memo that showcases your organization’s:

- Company Profile: Key business details, industry, and mission.

- Sustainability Profile: Your sustainability goals, carbon reduction initiatives, and environmental impact metrics.

- Financial Profile: Projected ROI, funding needs, and financial health.

This memo serves as a detailed snapshot to help lenders understand your project's alignment with their impact goals.

Step 2

Matching Projects to Loans

Using advanced algorithms and our network of financial institutions, we analyze your project’s type (e.g., renewable energy, waste-to-energy, or energy efficiency), geographical location, and scale to match you with the most suitable financing options.

Step 3

Access to Tailored Green Loans

Through our marketplace, we connect you with a variety of green financial instruments, including:

- Green bonds

- Sustainability-linked loans

- Grants for specific environmental initiatives

- Each option is tailored to fit your project’s requirements and long-term objectives.

Step 4

Facilitating Connections

We streamline the process by directly connecting you to lenders or investors who prioritize projects like yours. Our marketplace ensures transparency and clarity, reducing time-to-funding for your initiatives.

Step 5

Monitoring and Reporting Support

Post-funding, we offer support for tracking the impact of your financed project and generating sustainability reports, ensuring compliance with green finance standards, and demonstrating measurable outcomes to stakeholders.

Why choose Zero Circle?

Diverse investment options

Connect businesses to discounted capital via green loans, sustainability-linked loans, and transition finance programs geared toward net-zero goals.

Streamlined capital access & simplified processes

Automate loan applications and approvals, reducing overhead and expediting sustainable financing for mid-market firms.

Green taxonomy alignment

Ensure adherence to recognized sustainability standards, minimizing regulatory risks while meeting evolving green requirements.

AI-powered multi-stage sustainability assessment

Incorporate advanced technologies for robust sustainability evaluations, enabling transparent performance measurement and improvement.

Ongoing monitoring & comprehensive performance tracking

Maintain continuous visibility into funded projects, ensuring borrowers and lenders can jointly meet or exceed sustainability targets.

Integrated underwriting & reduced barriers

Merge financial risk models with financial metrics and sustainability metrics tackling the informational and regulatory obstacles that often hinder sustainable finance adoption.

Mid-market focus & global impact

Provide tailored options for businesses often overlooked by larger platforms, supporting broad-based net-zero transitions worldwide.

Scalability & marketplace automation

Facilitate high-volume onboarding of qualified applicants and seamless matching with funding providers, streamlining the entire financing ecosystem.

Efficiency, enhanced returns & risk reduction

Offer a single solution for sustainable lending—improving portfolio resilience, boosting profitability for financial institutions, and speeding sustainable growth for borrowers.

Our Pricing

6-month term

Upto $5M loan